Not known Details About Offshore Wealth Management

Table of ContentsOffshore Wealth Management - The Facts3 Simple Techniques For Offshore Wealth ManagementThe smart Trick of Offshore Wealth Management That Nobody is Talking AboutNot known Details About Offshore Wealth Management Things about Offshore Wealth Management

Offshore financial investments are frequently an eye-catching remedy where a parent has actually offered resources to a minor, or for those that can anticipate their marginal rate of tax obligation to fall. They also give a benefit to capitalists entitled to an age-related allowance, or expatriates who are spending while non-resident. In addition, offshore options might be proper for investors desiring to spend consistently or as a one-off swelling sum into a variety of property classes and also currencies.They can give you with the alternative of a routine income as well as additionally aid you to reduce your personal liability to Revenue as well as Funding Gains Tax Obligation. The value of a financial investment with St. offshore wealth management. James's Place will be directly linked to the performance of the funds you select and the worth can consequently go down along with up.

The degrees as well as bases of taxes, and remedies for taxation, can transform at any moment. The worth of any tax obligation relief depends on specific scenarios.

Rumored Buzz on Offshore Wealth Management

Numerous capitalists make use of traditional financial investments like an actual estate and also financial products, at repaired prices. From the lasting financial investment point of view, it can be much better to spend in resources owners whose performance is always more attractive.

Trusts are excellent financial investment lorries to secure possessions, and also they have the capability to hold a broad range of asset courses, consisting of residential property, shares and also art or collectibles - offshore wealth management. They also enable reliable distribution of properties to recipients. An offshore trust that is managed in a safe and secure jurisdiction enables efficient wealth production, tax-efficient administration and sequence planning.

Rumored Buzz on Offshore Wealth Management

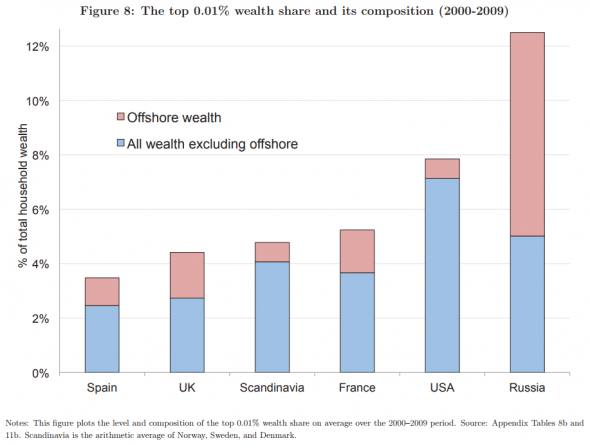

Clients who are afraid that their properties may be frozen or seized in case of potential political turmoil view offshore banking as an eye-catching, secure means to safeguard their properties. Numerous overseas accounts thin down the political risk to their wealth as well as minimize the danger of them having their assets frozen or taken in a financial dilemma.

Wilful non-declaration of the holdings is not. For instance, United States residents are needed to state possessions worth over US$ 10,000 in overseas accounts. With increased tax obligation openness and also tightening up of worldwide guidelines, it has ended up being a lot more challenging for people to open overseas accounts. The worldwide crackdown on tax avoidance has actually made offshore much less appealing and Switzerland, particularly, has actually seen a decrease in the number of offshore accounts being opened up.

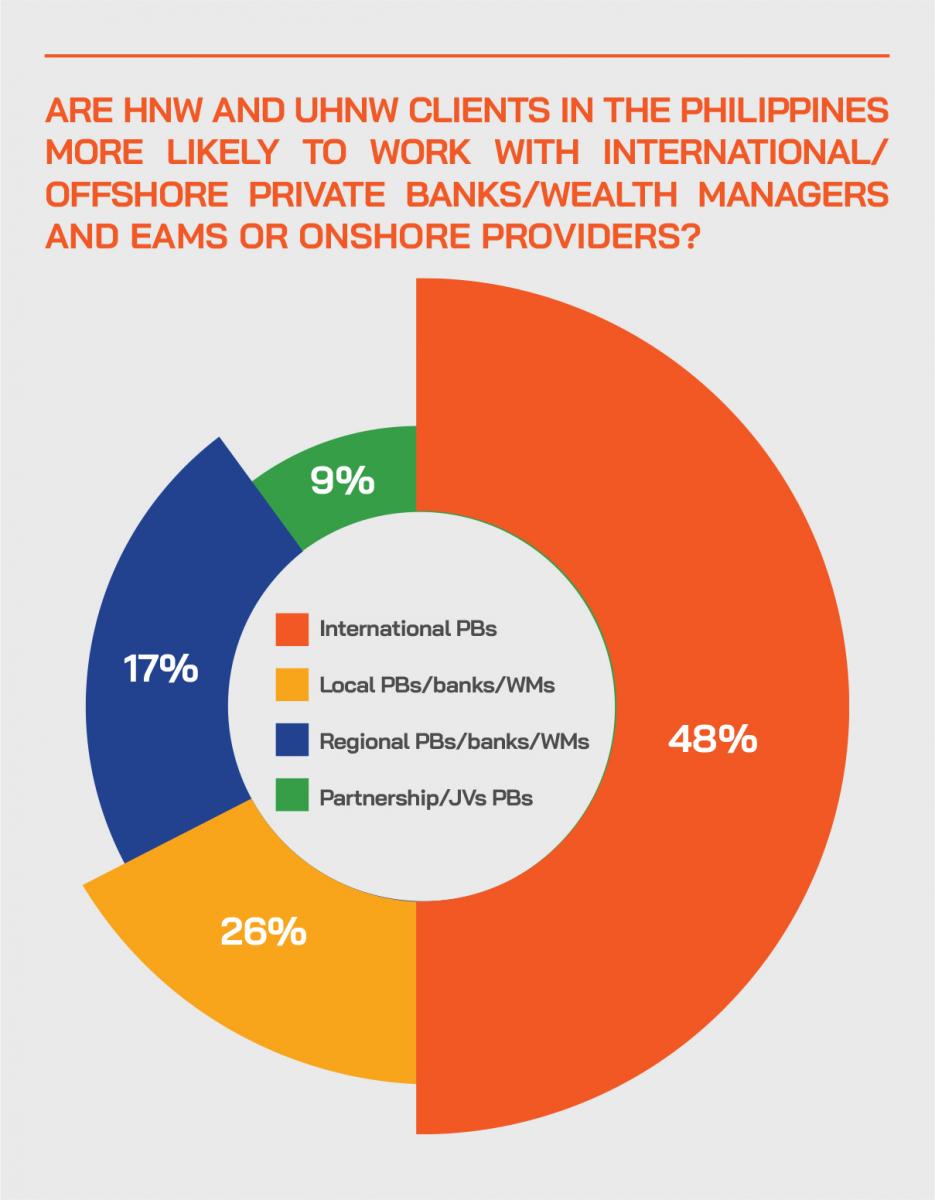

Onshore, offshore or a mix of the 2 will certainly make up an exclusive banker's customer base. The balance for each lender will be various depending upon where their clients wish to schedule their possessions. Dealing with offshore customers needs a somewhat different technique to onshore customers and can include the adhering to for the banker: They might be required to go across boundaries to check out clients in their residence country, also when the financial establishment they belong to does not have a long-term establishment situated there, Potentially take full duty for managing profile for the customer if the client is not a local, Be multilingual in order to effectively interact with clients and also construct their client base globally, Know worldwide regulations and also laws, particularly with concerns to offshore financial investments and also additional info tax, Have the ability to attach their clients to the right experts to assist them with various areas from tax obligation via to more functional assistance such as assisting with building, relocation, immigration consultants as well as education and learning consultants, Know the most up to date issues affecting worldwide clients why not find out more as well as ensure they can develop solutions to meet their needs, The financial institution and certain team within will establish the population of a banker's client base.

Our Offshore Wealth Management Diaries

Connects to the bigger monetary solutions industry in offshore centers Offshore investment is the keeping of cash in a territory various other than one's country of home. Offshore jurisdictions are made use of to pay less tax in several nations by large and small-scale investors.

The advantage to overseas investment is that such procedures are both legal as well as less pricey than those used in the capitalist's countryor "onshore". Payment of much less tax obligation is the driving force behind the majority of 'offshore' task.

Commonly, tax obligations levied by a financier's residence nation are important to the earnings of any kind of offered investment - offshore wealth management. Utilizing offshore-domiciled special purpose systems (or lorries) an investor may decrease the quantity of tax obligation payable, allowing the financier to attain higher earnings overall. Another reason 'offshore' investment is thought about remarkable to 'onshore' financial investment is due to the fact that it is less regulated, as well as the habits of the offshore investment service provider, whether he be a lender, fund manager, trustee or stock-broker, is freer than maybe in a much more regulated atmosphere.

Rumored Buzz on Offshore Wealth Management

Safeguarding against money decrease - As an example, Chinese investors have been investing their Go Here savings in stable Offshore places to secure their versus the decline of the renminbi. Offshore financial investments in badly controlled tax sanctuaries might bypass permissions versus nations developed to motivate conventions important to societies (e.Corporations are easily created in Produced and, and also they are heavily taxed greatly Strained operations, procedures pay no taxes on tax obligations activities. As a result, more than of 45,000 overseas covering business as well as subsidiaries business are produced in Panama each year; Panama has one of the greatest focus of subsidiaries of any country in the world.